Navigating Sri Lanka’s Employment Laws: A Guide for Global Businesses

Shalini Sewwandi

7/30/20252 min read

Expanding operations to Sri Lanka offers significant opportunities, thanks to its skilled workforce, strategic location, and growing economy. However, understanding Sri Lanka employment requirements is crucial for compliance and smooth operations. This guide breaks down key labor laws and explains how PEO services can simplify hiring and payroll management for foreign businesses.

Sri Lanka’s Labor Market Overview

Sri Lanka boasts a literacy rate of 93.3% and strong English proficiency, making it an attractive destination for businesses in IT, manufacturing, and outsourcing.

Key economic sectors include:

Tea and agricultural exports

Textile and apparel manufacturing

Tourism and logistics

The country’s GDP is projected at $84.5 billion in 2024, with steady growth driven by reforms and foreign investment incentives. However, navigating Sri Lanka labor laws can be complex, especially for companies without a local entity.

Key Employment Requirements in Sri Lanka

1. Employment Contracts & Probation Periods

Written contracts are standard, detailing job roles, wages, and working conditions.

The probation period typically lasts 6 months, though labor laws do not strictly define its duration.

2. Working Hours & Overtime Rules

Standard workweek: 45 hours (8 hours/day).

Overtime must be paid at 1.5x the regular wage, capped at 12 hours per week.

3. Employee Leave Entitlements

Annual Leave: 14 days after one year of service.

Maternity Leave: 84 days for the first two children (partial pay for the third child).

Casual Leave: 7 days per year for illness or personal reasons

4. Mandatory Employer Contributions

Employees’ Provident Fund (EPF): 12% employer contribution + 8% employee contribution.

Employees’ Trust Fund (ETF): 3% employer contribution.

5. Termination & Severance Pay

Employers must obtain written consent from the employee or approval from the Commissioner of Labour before termination.

Severance pay ranges from 0.5 to 2.5 months’ salary per year, depending on tenure.

Challenges of Hiring Directly in Sri Lanka

Setting up a legal entity in Sri Lanka involves:

Lengthy registration processes (4-6 months).

Complex payroll management (EPF, ETF, PAYE taxes).

Risk of non-compliance with evolving labor laws

This is where PEO services in Sri Lanka become invaluable.

How PEO Services Simplify Hiring in Sri Lanka

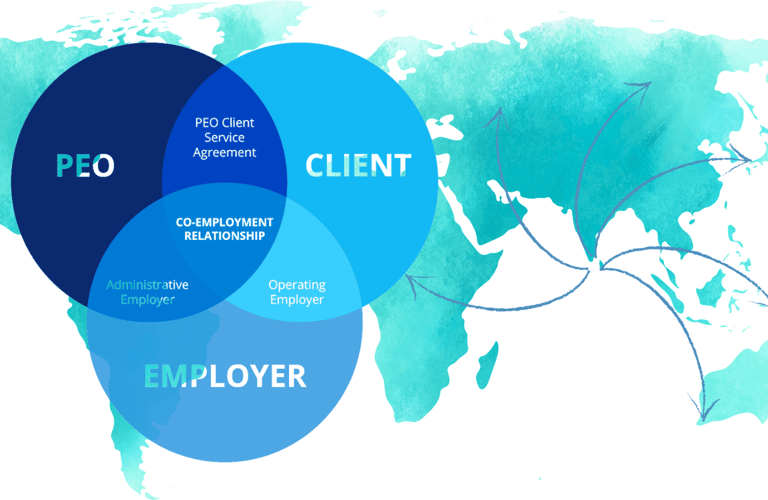

A Professional Employer Organization (PEO) acts as the Employer of Record (EOR), handling:

Compliance with Labor Laws

Managing EPF, ETF, and tax filings to avoid penalties10.

Ensuring adherence to termination rules and severance pay.

Payroll & Benefits Administration

Processing salaries in Sri Lankan Rupees (LKR).

Handling paid leave, Poya holidays, and overtime calculations.

Faster Market Entry

No need for a local entity, employees can be hired in days, not months.

Cost-effective for businesses with low headcounts.

Recruitment & Talent Management

Access to Sri Lanka’s skilled workforce in IT, engineering, and finance.

Managing work visas for foreign hires (if needed).

Why it is beneficial to Choose PEOs for Sri Lanka Expansion

Cost Efficiency – Avoid entity setup costs (starting at $199/month per employee vs. $500+ for incorporation).

Risk Mitigation – PEOs handle legal compliance, reducing exposure to fines.

Scalability – Hire one employee or an entire team without administrative burdens.

Navigating Sri Lanka employment requirements doesn’t have to be a barrier to expansion.

By leveraging PEO services, businesses can:

Hire compliantly without a local entity.

Streamline payroll and benefits administration.

Focus on growth while leaving HR complexities to experts.

For companies eyeing Sri Lanka’s talent pool, partnering with a PEO ensures seamless, compliant operations in this dynamic market.

Contact

support@rankflowservices.com

Copyright©Rankflow Services 2025. All rights reserved.

Solutions

Resources

Company

Quick Links